See This Report on Top Tulsa Bankruptcy Lawyers

See This Report on Top Tulsa Bankruptcy Lawyers

Blog Article

3 Simple Techniques For Tulsa Bankruptcy Filing Assistance

Table of ContentsNot known Incorrect Statements About Tulsa Bankruptcy Lawyer Things about Chapter 7 - Bankruptcy BasicsHow Top Tulsa Bankruptcy Lawyers can Save You Time, Stress, and Money.Getting My Chapter 7 Vs Chapter 13 Bankruptcy To WorkGetting My Experienced Bankruptcy Lawyer Tulsa To Work

The stats for the other major kind, Phase 13, are even worse for pro se filers. (We damage down the differences between the 2 key ins deepness below.) Suffice it to say, talk with a lawyer or 2 near you who's experienced with insolvency law. Right here are a few resources to find them: It's easy to understand that you could be reluctant to spend for a lawyer when you're already under significant economic pressure.Several attorneys additionally supply cost-free examinations or email Q&A s. Capitalize on that. (The non-profit application Upsolve can aid you find totally free assessments, resources and lawful assistance at no cost.) Ask them if insolvency is certainly the ideal selection for your circumstance and whether they assume you'll qualify. Prior to you pay to file personal bankruptcy forms and blemish your credit scores record for as much as ten years, examine to see if you have any kind of practical options like financial debt negotiation or charitable credit rating therapy.

Ad Currently that you have actually decided bankruptcy is without a doubt the appropriate program of action and you with any luck removed it with an attorney you'll require to get started on the documents. Before you dive right into all the official personal bankruptcy kinds, you should get your own papers in order.

All About Top Tulsa Bankruptcy Lawyers

Later down the line, you'll in fact need to show that by divulging all type of info regarding your economic events. Below's a fundamental list of what you'll require when driving ahead: Determining papers like your motorist's permit and Social Safety card Income tax return (up to the past four years) Proof of revenue (pay stubs, W-2s, freelance incomes, revenue from properties along with any type of income from federal government advantages) Bank statements and/or pension declarations Evidence of worth of your possessions, such as vehicle and realty evaluation.

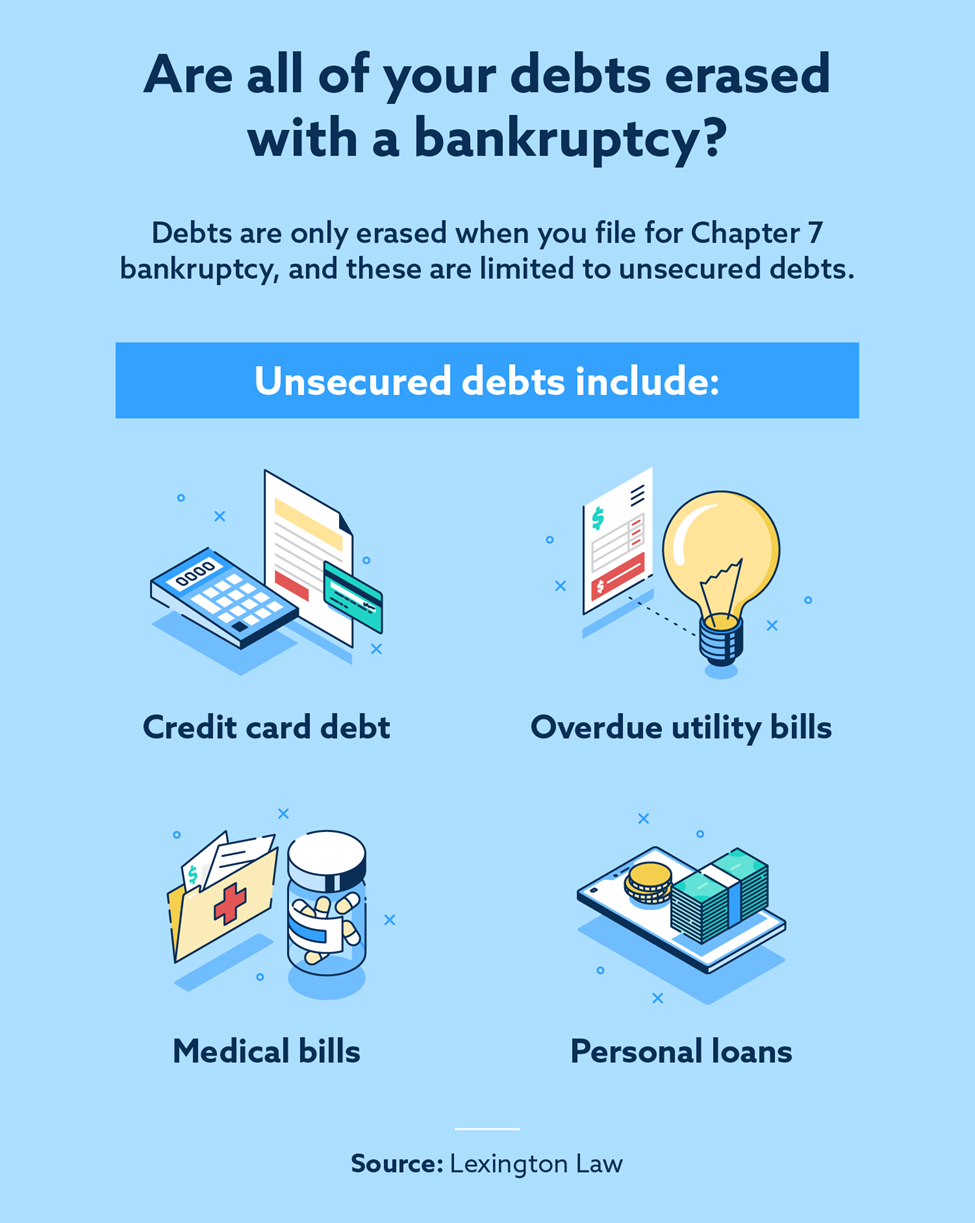

You'll desire to recognize what type of financial debt you're trying to solve.

You'll desire to recognize what type of financial debt you're trying to solve.If your revenue is too expensive, you have an additional option: Phase 13. This choice takes longer to resolve your financial obligations since it needs a lasting payment plan usually three to five years before some of your remaining debts are wiped away. The declaring process is likewise a whole lot more complicated than Chapter 7.

All About Chapter 7 Bankruptcy Attorney Tulsa

A Phase 7 bankruptcy stays on your credit report for ten years, whereas a Chapter 13 insolvency diminishes after 7. Both have long-term effect on your credit rating, and any kind of new financial debt you secure will likely include greater interest rates. Before you send your insolvency forms, you must first finish a necessary training course from a credit report therapy company that has been authorized by the Department of Justice (with the notable exemption of filers in Alabama or North Carolina).

The course can be finished online, in person or over the phone. Training courses usually set you back in between $15 and $50. You should finish the training course within 180 days of declare personal bankruptcy (bankruptcy lawyer Tulsa). Use the Department of Justice's web site to discover a program. If you reside in Alabama or North Carolina, you should select and finish a program from a listing of separately authorized providers in your state.

9 Easy Facts About Bankruptcy Attorney Near Me Tulsa Explained

A lawyer will commonly handle this for you. If you're filing by yourself, recognize that there are concerning 90 different insolvency areas. Inspect that you're filing with the appropriate one based on where you live. If your copyright has moved within 180 days of filling up, you must file in the area where you lived like this the greater section of that 180-day period.

Typically, your bankruptcy lawyer will function with the trustee, but you may require to send out the person records such as pay stubs, tax returns, and financial institution account and credit scores card statements straight. A typical false impression with personal bankruptcy is that once you submit, you can quit paying your financial debts. While insolvency can aid you wipe out many of your unsafe financial debts, such as overdue clinical expenses or personal finances, you'll want to keep paying your month-to-month payments for safe financial debts if you want to keep the building.

The Main Principles Of Experienced Bankruptcy Lawyer Tulsa

If you go to risk of foreclosure and have worn down all other financial-relief alternatives, after that applying for Phase 13 may postpone the foreclosure and assistance save your home. Inevitably, you will still need the income to continue making future home mortgage payments, along with paying off any type of late payments over the course of your payment strategy.

If so, you might be called for to supply extra info. The audit could postpone any type of debt alleviation by several weeks. Of training course, if the audit shows up wrong info, your situation might be disregarded. All that said, these are relatively bankruptcy attorney Tulsa uncommon circumstances. That you made it this much while doing so is a respectable sign at least several of your financial debts are qualified for discharge.

Report this page